HMRC wants digital. With COHO, you already are.

COHO combines powerful property management tools with built-in MTD reporting so landlords can stay compliant, without switching systems or stacking up costs.

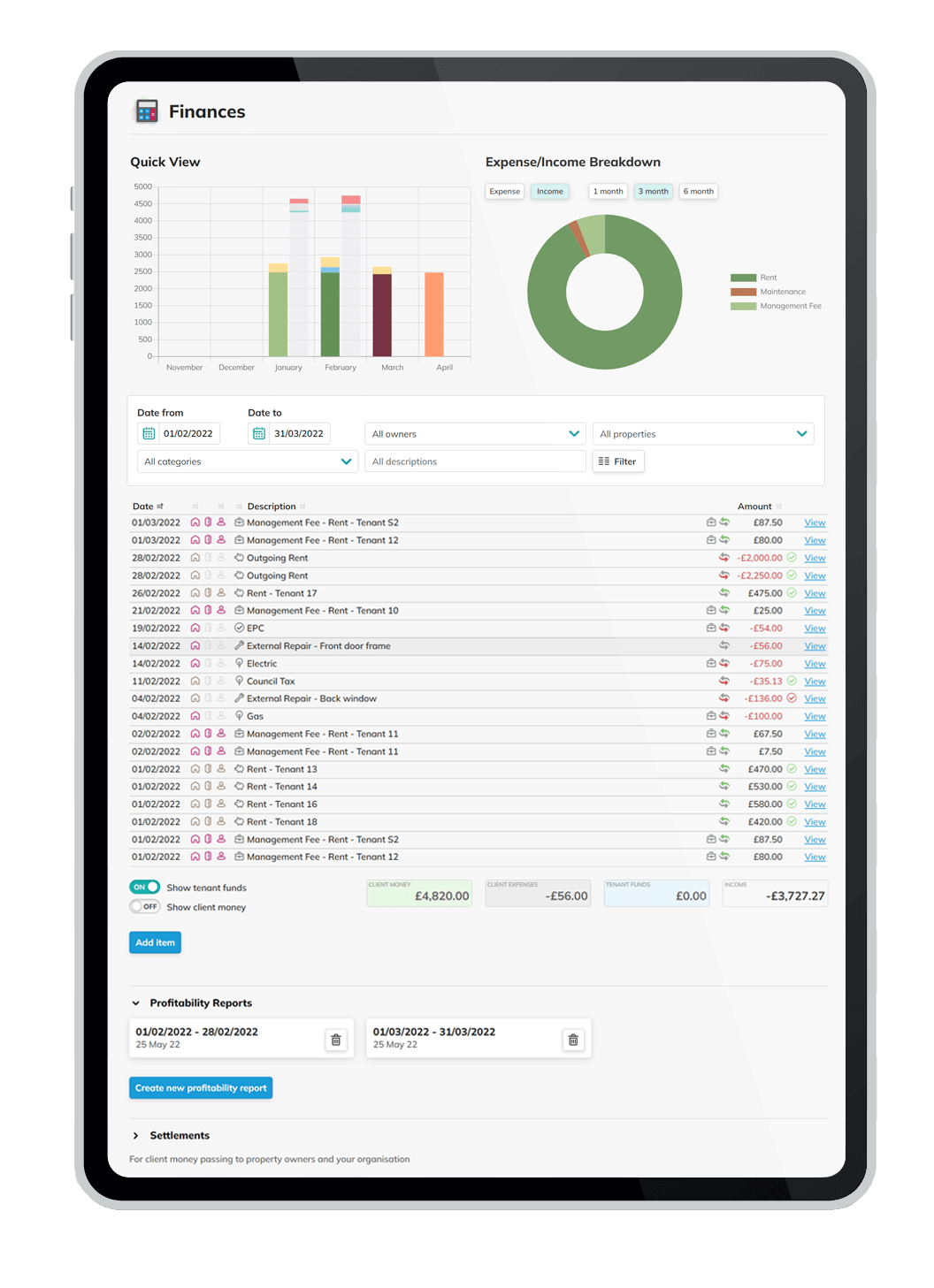

The all-in-one landlord bookkeeping and compliance solution

Integrated MTD compliance recognised by HMRC

COHO already integrates MTD compliance into its property management platform. This means landlords don't need to pay for, learn or manage separate tax software.

All-in-one simplicity

Generate reports directly from the same platform you use to manage your portfolio. With COHO, your property management tools and tax compliance tools are the same. This eliminates double-entry, minimising errors and saving time.

No added cost for compliance

Unlike standalone landlord accounting software, COHO's compliance features are part of the same platform you're already using.

Integrated MTD compliance recognised by HMRC

COHO already integrates MTD compliance into its property management platform. This means landlords don't need to pay for, learn or manage separate tax software.

All-in-one simplicity

Generate reports directly from the same platform you use to manage your portfolio. With COHO, your property management tools and tax compliance tools are the same. This eliminates double-entry, minimising errors and saving time.

No added cost for compliance

Unlike standalone landlord accounting software, COHO's compliance features are part of the same platform you're already using.

Compliance doesn't have to complicate your life.

With COHO, you're already covered.

Frequently asked questions

What is Making Tax Digital and how does it impact landlords?

Making Tax Digital (MTD) is a government iniative to modernise tax reporting. For landlords, it means digital record-keeping and quarterly submissions to HMRC. It sounds complicated, but it doesn;t have to be.

Do landlords need specific software for Making Tax Digital?

Yes! From April 2026, HMRC will require landlords earning over £50,000 to use MTD-compliant software to submit quarterly digital tax updates. COHO includes thjis functionality as part of its platform and is compliant with HMRC.

What's the best software for landlords who need to follow MTD rules?

The best software is one that helps you to stay compliant and manage your properties efficiently. COHO has integared MTD reporting, rent collection, document storage and more, all in one place.